In the latest edition of the Numbers Report, we will take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

- India Mulls Its Options as Refiners Slow Down Russian Purchases

- US President Donald Trump is set to impose an additional 25% tariff on India, bringing the total rate to 50%, after US-India trade talks did not lead to any agreement and the White House penalized Delhi for purchasing Russian oil.

- Unless Delhi finds a way to negotiate a deal, Trump’s 50% tariff threat will materialize on August 27, adding headache to the country’s refiners as they weigh the risks of continued Russian imports.

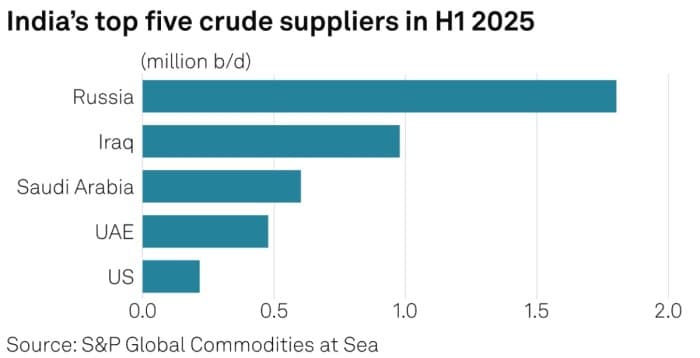

- India’s oil imports from Russia have averaged 1.8 million b/d in 2025 to date, slightly higher than the 1.78 million b/d average of the past two years, with private refiners Reliance and Nayara accounting for half of those volumes.

- Both private refiners have term contract with Russia and have stated they will not halt imports unless directly mandated to do so by the government, whilst state-owned refiners have curbed their purchases.

- India’s state-owned refiners IOC and BPCL have bought a combined 22 million barrels of crude for September and October arrivals, relying mostly on West African and Middle Eastern grades.

- Mirroring US Shale, Saudi Arabia Slows Down Oil Drilling

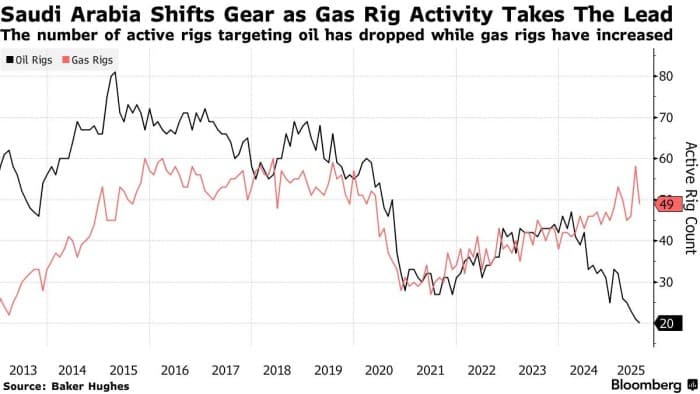

- The oil markets have been closely following the continuously declining number of active US oil rigs, falling for 14 consecutive weeks, however the world’s most cost-efficient producer is also cutting down on drilling expenditures.

- According to Baker Hughes, Saudi Arabia’s oil rig count fell to a mere 20 in July, down from 46 in early 2024 and marking the lowest monthly level since February 2205 after 18 months of incessant declines.

- Simultaneously, gas rigs are on the rise as Saudi Aramco’s largest upcoming project – Jafurah – is about to see the commissioning of Phase 1, adding 0.65 BCf/d of natural gas production soon.

- Baker Hughes later clarified that there’s more than 230 drilling rigs located currently in Saudi Arabia, however it counts only active ones that are drilling and have not yet reached target depth, excluding testing rigs, completions or workovers.

- China’s Crude Imports Ease as SPR Buying Cools Down

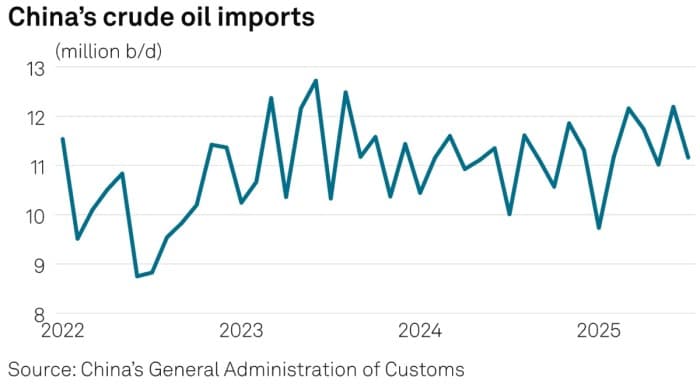

- China’s crude oil imports decreased slightly month-over-month to 11.16 million b/d, according to the country’s General Administration of Customs, probably marking the end of the great Chinese stock-building spree in H1 2025.

- According to Kpler, Chinese refiners and storage operators added 80 million barrels in storage between March and July, taking the total volume of crude stored across the country to 1.13 billion barrels.

- Without any further SPR builds, China’s crude imports are believed to trend lower around 11 million b/d in August-December, some 200,000 b/d lower than over the same period last year.

- Russia remains the largest crude supplier to the Chinese market, with 2.05 million b/d delivered last month, whilst Saudi Arabia’s July exports to China dipped slightly lower to 1.48 million b/d.

- Who Needs Fuel Oil if You Can Get LNG?

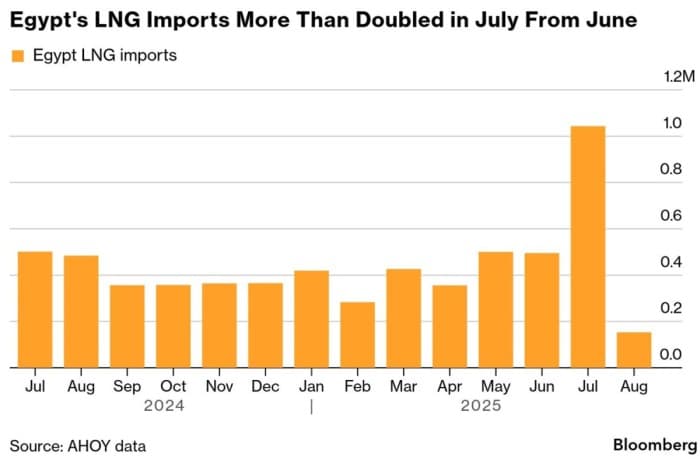

- Egypt has been forgoing its tendered fuel oil deliveries after maximizing imports of natural gas, both from global LNG markets and via pipeline from Israel, to cover its summer needs.

- EGPC, the state oil company of the North African country, is now relinquishing more than 2 million barrels of fuel oil cargoes it had bought in May-June, cancelling half of its initial August-delivery plan.

- Following the restart of Israel’s Leviathan field, Israel has signed a 35 billion deal to supply pipeline gas to Egypt until 2040 for an average price of $7.75 per mmBtu, some $4 per mmBtu cheaper than current market prices of LNG.

- Egypt has imported 1 million tonnes of LNG last month, an all-time high and double of the previous record in July 2024, having added two new FSRUs for regasification of LNG cargoes.

- The switch from HSFO to LNG might stem from tight state coffers as Egypt’s LNG imports offer a generous 180-day payment deferral whilst sellers of fuel oil most probably demand prompter payment.

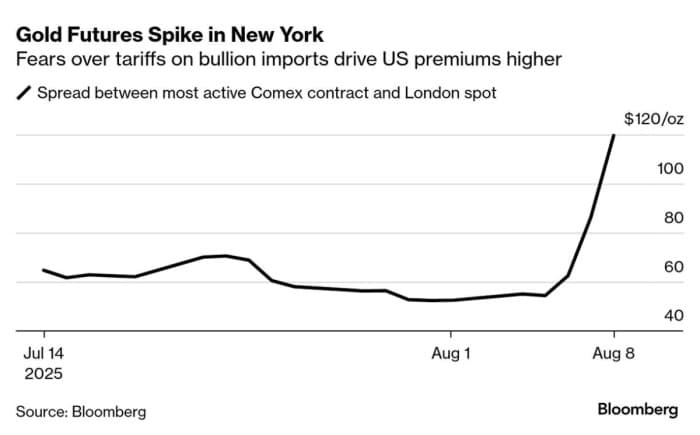

- Trump’s Gold Bullion Tariff Triggers Another US Rally

- US gold futures surged to an all-time high of $3,534 per troy ounce after the Financial Times reported on the Trump administration’s plans to impose tariffs on imports of 1 kg bullion bars.

- Citing a July 31 Customs and Border Protection letter, the FT claims bullion bars will be re-classified under a customs code that is subject to higher import duties.

- Adding to pressure on US gold futures, Switzerland – the country that just this week saw a 39% tariff slap – is the world’s largest gold refining hub and a major exporter of bullion to the United States.

- Following similar moves in copper, US gold is now wielding a $120 per ounce premium over London prices, prompting several gold refiners across the world to temporarily halt shipments.

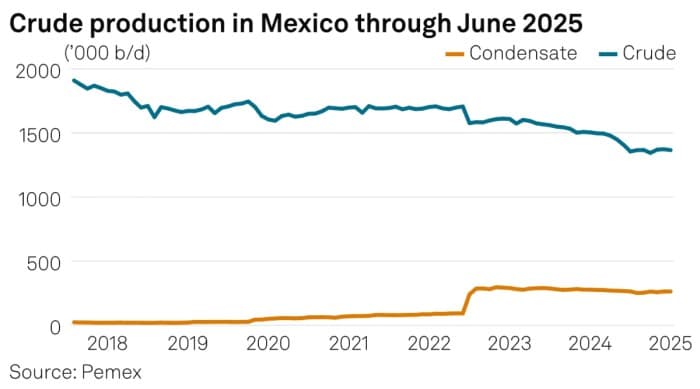

- Mexico Plans Massive Pemex Revamp, Paid by the State

- The national oil company of Mexico, Petroleos Mexicanos or Pemex, has unveiled its new 10-year strategy to revamp its operations, halt production declines and lower the company’s notoriously high debt burden.

- Pemex’s oil production plunged to just 1.366 million b/d in June, mirroring an 8% year-over-year decline across Mexico, as the lack of new field launches is aggravated by declines at the country’s mature assets.

- Mexican President Claudia Sheinbaum announced a new financial vehicle worth $13 billion to help Pemex pay down its massive backlog of service provider debt, believed to be above $23 billion.

- Mexico is set to post the world’s largest crude and condensate production decline by 2030, with the IEA projecting an almost 700,000 b/d output drop by the end of this decade as Pemex’s $99 billion debt debilitates its recovery.

- Platinum Rallies as Both US and China Seek to Stock Up

- After the copper bubble burst, platinum could be the next big inventory trade of 2025, however US buyers will have to confront similarly robust buying from another contender – China.

- Platinum prices are approximately 48% up in 2025 to date, with NYMEX prices trading above $1,350 per ounce in recent days and potentially even higher as global inventory of the rare metal continue to shrink.

- Since early July, platinum stockpiles held in US warehouses have soared by 105% and reached 566 thousand ounces, creating a shortfall of the metal in European trading hubs, namely London and Zurich.

- Concurrently to higher flows to the US, China bought up a record 1.2 million ounces of platinum in Q2, well above its domestic demand readings, with state-controlled China Platinum accounting for most of those purchases.

- Higher platinum prices are coming at the right time for miner as 90% of the platinum-mining industry is now in the money.

Source: oilprice.com